Sri Lanka, a tropical island nation located in the Indian Ocean, was once a British colony for nearly 150 years. The country gained independence in 1948, following a long and arduous struggle for freedom. The independence movement was driven by a number of factors, including economic exploitation, cultural oppression, and a desire for self-determination. Despite the challenges faced, Sri Lanka has made significant progress in the decades since independence, particularly in the fields of education and healthcare. However, the country is currently facing significant economic and political challenges, which threaten to undermine the progress made thus far.

The Road to Independence

The British first established control over Sri Lanka in 1796, when the Dutch East India Company handed over the coastal areas of the island to the British. Over the next century and a half, the British expanded their control over the entire island, establishing a colonial administration and exploiting the country’s resources for their own gain. The economic exploitation of Sri Lanka was a major factor in driving the independence movement, as the British extracted vast sums of wealth from the country, leaving the local population in poverty.

The independence movement was led by a number of key figures, including Don Stephen Senanayake, who went on to become the first Prime Minister of Sri Lanka. The movement gained momentum in the 1930s and 1940s, as the Indian independence movement inspired Sri Lankans to seek freedom from British rule. In 1948, Sri Lanka finally gained independence, with Senanayake as its first Prime Minister. The country adopted a new constitution and established a parliamentary democracy, with a Westminster-style system of government.

Pros and Cons of Independence

Since independence, Sri Lanka has made significant progress in a number of areas. One of the most notable achievements has been in the field of education. The country has established a strong education system, with a high literacy rate and a number of top-quality universities. This has helped to improve the economic and social prospects of the country, providing opportunities for young people to improve their lives and contribute to the development of the nation.

Another major achievement has been in the field of healthcare. The country has established a comprehensive healthcare system, providing access to basic medical services for all its citizens. This has improved the health and well-being of the population, helping to reduce infant and maternal mortality rates, as well as other health indicators.

However, despite these achievements, Sri Lanka has faced a number of challenges since its independence. One of the most significant has been ethnic tensions, particularly between the Sinhalese majority and the Tamil minority. The conflict has led to violence and political instability, particularly in the north and east of the country. This has significantly impacted the economy, undermining investor confidence and slowing economic growth.

The Ongoing Economic Crisis

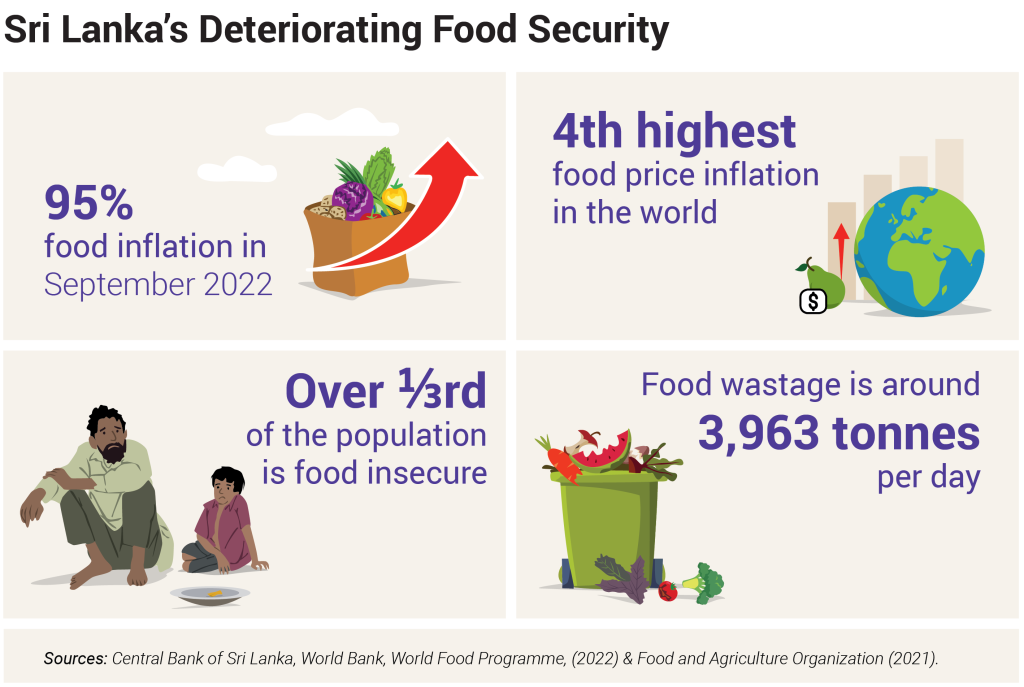

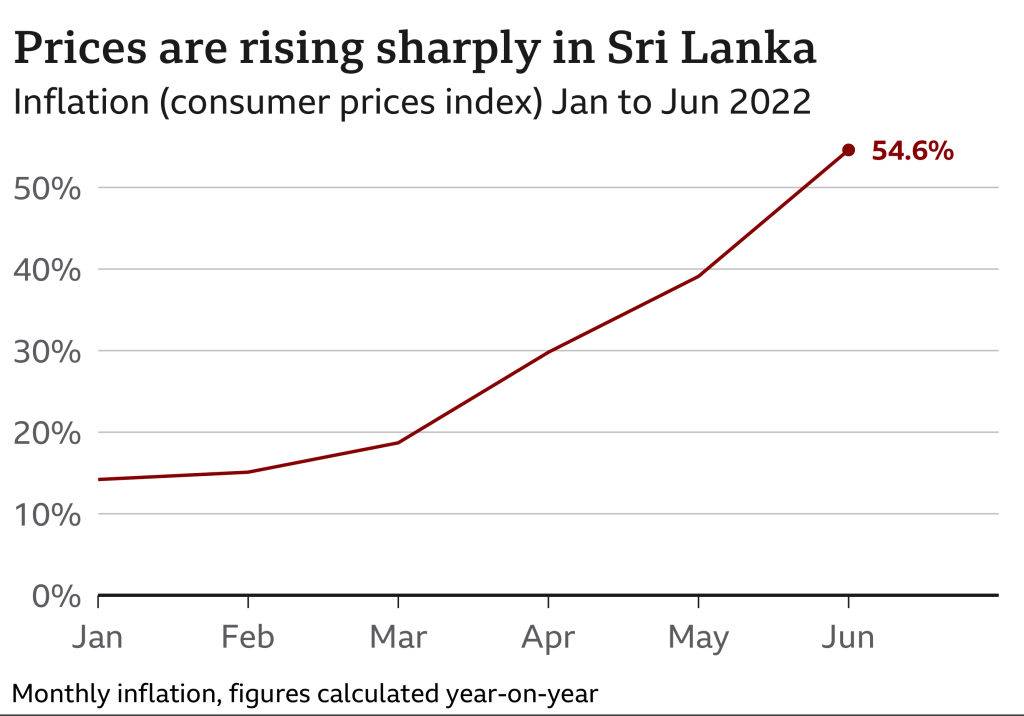

Unfortunately, despite these achievements, the country has recently faced significant economic challenges. In recent years, Sri Lanka has been facing a severe economic crisis, which has led to a devaluation of its currency, inflation, and a large amount of government debt. This has resulted in a decrease in the standard of living for many citizens, as well as decreased investment and a slowdown in the country’s economic growth.

One of the main reasons for the economic crisis in Sri Lanka is the large amount of government debt. The government has taken out loans from foreign countries and international financial institutions but has been unable to repay them due to a combination of factors, including low revenue and high levels of corruption. This has led to a reduction in foreign investment and a decrease in the country’s economic growth, which has in turn led to increased poverty and decreased opportunities for many citizens.

Another major challenge facing Sri Lanka’s economy is inflation. In recent years, the country has experienced high levels of inflation, which has been driven by factors such as the increasing cost of living and decreased economic growth. This has led to decreased purchasing power for many citizens, as well as decreased investment in the country and decreased economic growth.

Despite these challenges, there are also many positive developments in Sri Lanka. The country has a rich cultural heritage and a diverse landscape, which includes stunning beaches, lush forests, and ancient ruins. Additionally, the country has a well-educated and hard-working population, which is eager to participate in the country’s development.

In recent years, the government has taken steps to address the economic crisis and improve the country’s economic growth. For example, the government has implemented reforms to increase revenue and reduce corruption and has taken steps to improve the business environment in order to attract more investment. Additionally, the government has implemented social welfare programs aimed at improving the standard of living for its citizens, including programs aimed at reducing poverty and increasing access to education and healthcare.

Despite these efforts, there is still much work to be done in order to address the economic challenges facing Sri Lanka. The country must continue to work to reduce government debt, increase revenue, and improve the business environment in order to attract more investment and boost economic growth. Additionally, the government must take steps to address the high levels of inflation and the increasing cost of living, in order to ensure that its citizens are able to live a comfortable and secure life.

In conclusion, Sri Lanka has come a long way since gaining independence from British rule in 1948. The country has made significant progress in areas such as education, healthcare, and human rights, and has a rich cultural heritage and a diverse landscape. However, it is also facing significant economic challenges, including government debt, inflation, and decreased economic growth. In order to overcome these challenges, the government must continue to work to increase revenue, reduce corruption, and improve the business environment, while also taking steps to improve the standard of living for its citizens. With these efforts, Sri Lanka can continue on its path towards a bright and prosperous future.